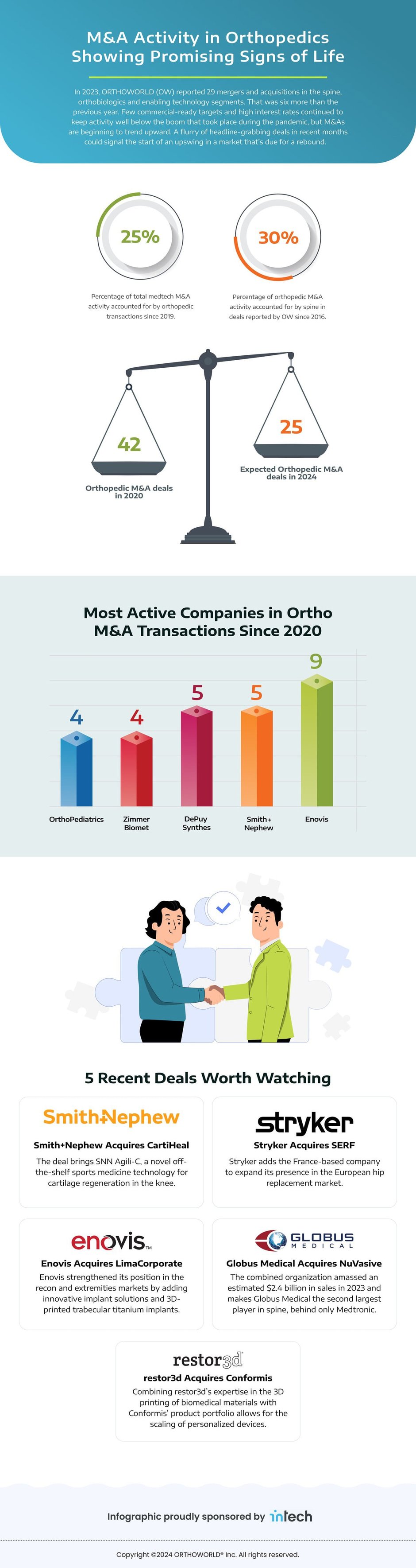

Orthopedic M&A deals accelerated in 2023, according to ORTHOWORLD reporting. The jump in activity marks the first year-over-year increase since 2020, but still fell short of the 42 orthopedic transactions ORTHOWORLD tracked that year. Still, there’s reason for optimism and a livelier M&A market in the years ahead. Interest in orthopedic M&A remains strong and a few major players have with recent acquisitions:

- Smith+Nephew acquired CartiHeal last November to capture the company’s novel technology for regenerating cartilage in the knee.

- Enovis acquired LimaCorporate in January to gain addition tractions in the extremities and reconstruction segments.

- Stryker acquired France-based SERF in December to add to its hip replacement portfolio across Europe.

- Globus Medical became the second biggest player in spine — the most active M&A segment in orthopedics — when it completed its merger with NuVasive last September.

- restor3d acquired Conformis last year with the goal of scaling Conformis’ portfolio of personalized orthopedic devices.

ORTHOWORLD expects M&A deal volume to hold steady in 2024 amid the higher input costs for buyers and the relative scarcity of commercial-ready companies. However, the market could become more active sometime in 2025 as interest in orthopedic targets remains strong.

See the original article on Orthoworld

.jpg?width=352&name=large-Intech_Brochure-min%20(1).jpg)

Leave a Comment